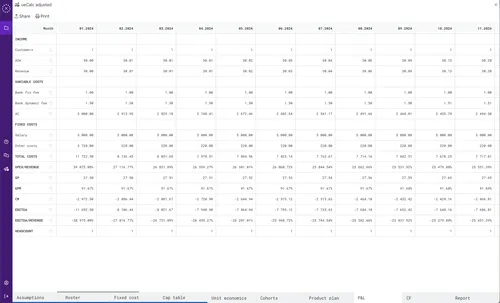

All startup financial models are presented in a consistent style and format, free of formula errors, with clear performance metrics.

- Single Standard. All financial models are presented in a unified format, and startups cannot alter this standard.

- The model is based on the team's capabilities. A startup constructs its financial model according to its competencies in managing business processes. Your role is to evaluate these capabilities, which you can easily do using Plan-Actual Analysis. This tool immediately highlights which business processes are underperforming and need attention.

- Capitalization Table. The automatic construction of the capitalization table helps you account for various investment stages. For example, you can segment the investment into different stages of varying durations and calculate the precise amount of required investment for each stage of the project.

Managing a portfolio of early-stage startups is a highly labor-intensive task. Many startups struggle with creating financial models and, even more so, explaining them. We offer a streamlined solution with standardized financial models that any founder can easily explain, as they are tailored to the competencies and experience of their team. This means you no longer need to scrutinize formulas and calculations; instead, you can simply assess the feasibility of each project using Plan-Actual analysis.

Integrate your portfolio with our service!

Daniil Khanin, CEO ueCalc

How many users can I have on the Pro plan? On the Pro plan, you can create as many users as needed. There are currently no technical limitations.Is there a Document Permissions Management feature? On the Pro plan, there are two types of users: Administrators, who have access to all documents in the account, and Users, who have access only to their own documents. You manage the document permissions for your account.

ueCalc

Made with love for the whole world

We believe that anyone can attempt to start their own business, and we are here to assist them.

- Products

- Calconomics

- Company

- © 2026 Khanin Solutions S.L.

Barcelona, Spain