With our templates you are build a financial model fast and correct, without any prior experience or expertise in finance.

- Transaction Model is perfect for businesses where managing the average cost per transaction isn't a primary concern. If your product or service prices remain consistent regardless of customer preferences, this straightforward template is ideal. It's especially beneficial for an initial assessment of your business.

- The commerce model is ideal for businesses involved in the trade of goods. It allows you to tailor your business model with precision, factoring in the structure of your shopping cart, including the number of items and the average price per item. The financial model will consider all the specific details of your business.

- The SaaS model is perfect for businesses with a subscription-based structure. It enables you to finely adjust your pricing plans, helping you identify the optimal distribution of customers across different plans, durations, and costs.

Turnkey Financial Model: By entering your business process metrics at the start of the project, you will receive a comprehensive financial model package including staffing table, fixed cost budget, capitalization table, unit economics calculation, profit and loss forecast, cash flow forecast, detailed product plan and summary report. This solution requires minimal effort on your part - and then simply share a link to the model with your investor.

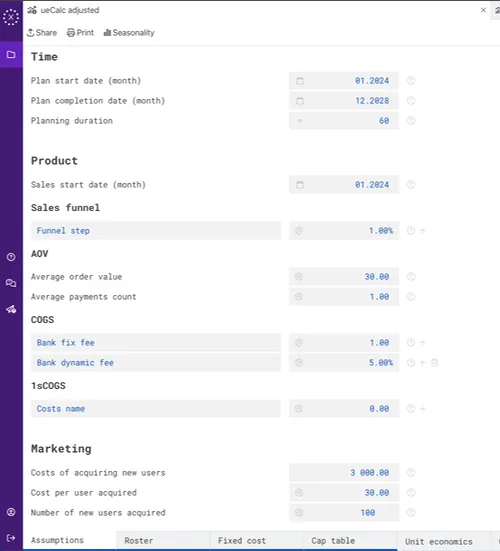

- Specify a modeling period. You can create a model with a duration from 2 to 120 months. Your model can start in any month of the year, not just January. And you can easily change the plan dates, ueCalc will recalculate everything automatically.

- Define Your Sales Funnel. Identify the stages your customer goes through from initial contact to completing a purchase of your product or service. If you're unsure, simply provide the conversion rate from lead to customer.

- Customize Your Average Order Value. Different business models have varying approaches to monetization. Define how your average order value is structured. If you operate a SaaS business, describe your pricing plans, and ueCalc will calculate the average order value for you.

- Customize Costs. List the costs you incur for each customer transaction, excluding marketing expenses. ueCalc can interpret both absolute values and relative values as a percentage of the average order value.

- Describe the marketing. Specify your initial costs to attract leads, including the total budget and the cost or number of leads acquired.

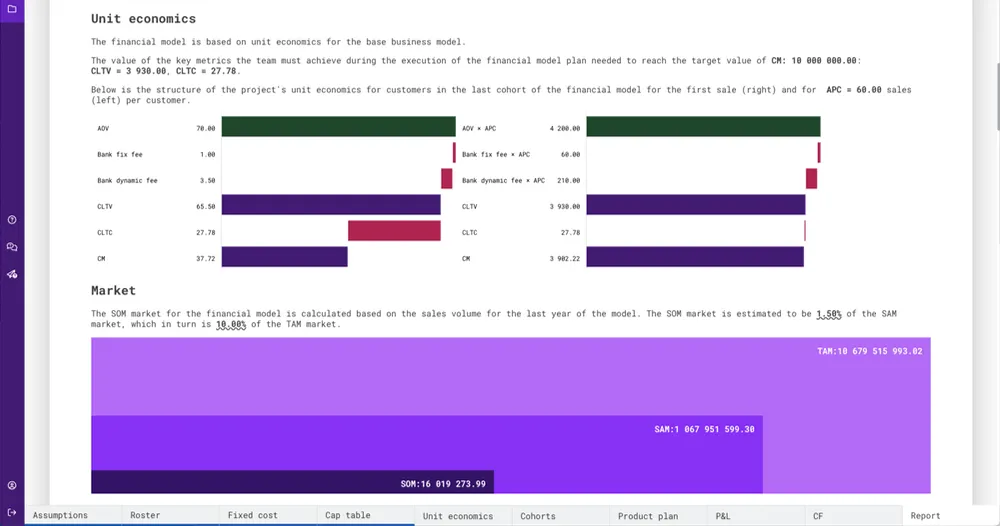

- Set a target value. To build a financial model, ueCalc utilizes unit economics and Goldratt's Theory of Constraints. Therefore, you need to establish a target value for the profit margin you plan to achieve from the cohort of customers acquired in the last month of the plan. ueCalc's built-in analytical algorithm will optimize your business processes to ensure that the final unit economics allow you to reach the specified profit margin with minimal costs associated with changes in the business processes linked to your product's unit economics.

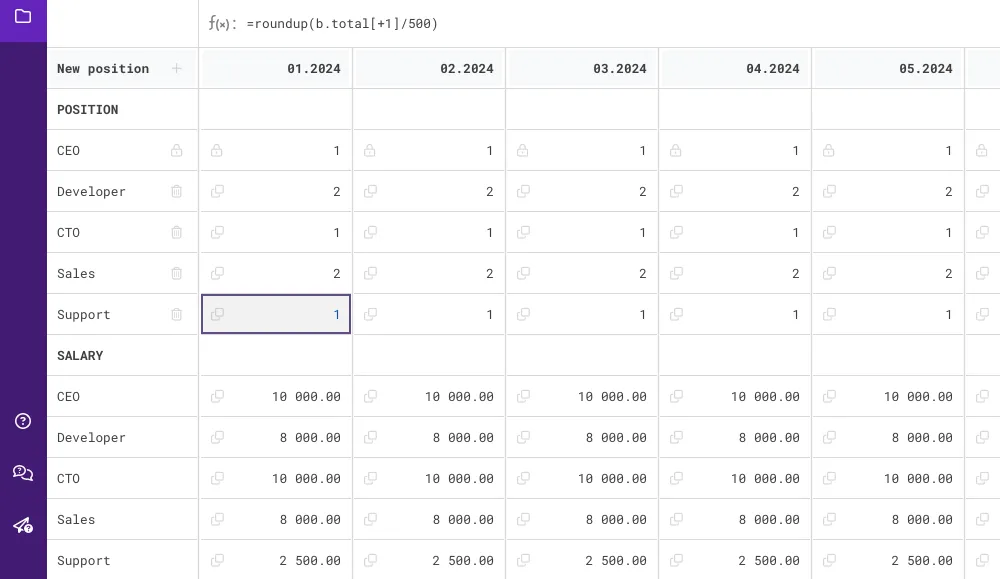

- Set Positions and Salaries. Specify which employees you plan to hire to fulfill your plan and the salaries you intend to pay them. Remember that salaries should include taxes.

- Set Fixed Costs. List your expenses that will be incurred regardless of sales, such as rent, equipment costs, and fees for various services.

- Use the formulas. If the number of employees depends on the number of your customers, use formulas to automatically fill in the number of employees based on the predicted number of customers. Simply specify the dependency, and ueCalc will automatically populate the table. Formulas are also used in calculating fixed costs; for example, you can compute the cost of employee salaries based on the number of new employees for each period.

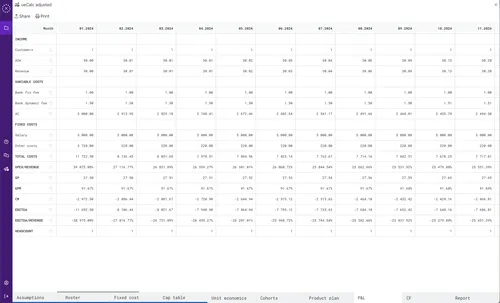

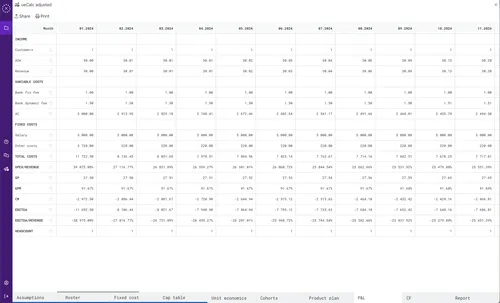

- P&L Review the forecast results on the P&L tab, where you can view a detailed profit and loss plan for your model. This plan is automatically generated based on the unit economics that describe your business processes.

- Ease of Viewing. For convenience, you can select from three types of data presentation: monthly, quarterly, or annual aggregation.

- Cash Flow. Use the CF tab to analyze cash flows for your project. This tab forecasts cash flows, considering discounting factors, which you can configure separately.

- Summary Report. The Report tab provides a comprehensive summary of the project, including key deliverables, unit economics calculations, investment valuation, market valuation, P&L and CF summaries, and the assumptions used in the model.

- PDF and Share. You can print and download the report as a PDF. Additionally, you can share your model with external users via a link, allowing them to view but not modify the information. Optionally, you can password-protect the document and permit making a copy. Review the example model to see how it works.

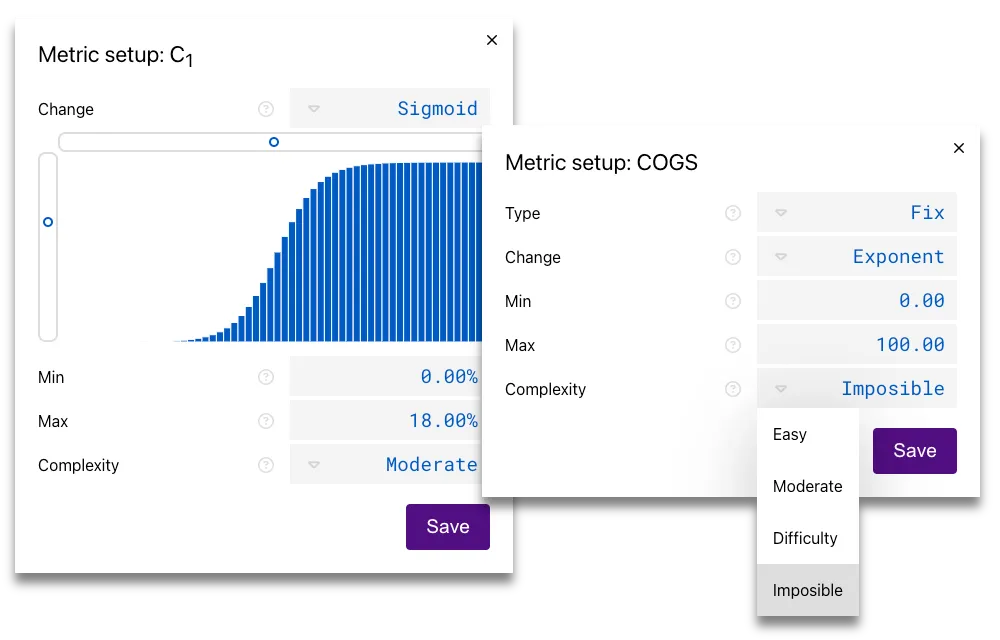

- Metrics Customization. Each metric in your business model can be individually customized. You can set limits on how ueCalc algorithms can modify the metric, such as specifying minimum and maximum values that the metric can take.

- Difficulty of Changing Metrics. ueCalc employs Goldratt's Theory of Constraints to find the optimal configuration of business processes. You can set the difficulty of changing each metric based on how challenging it is for you to improve. Specify this in the metric settings for each process, and ueCalc will account for it in its analysis. Additionally, remember to indicate processes that cannot be improved at all, such as bank fees.

- Change in Growth Rate. Each process in your plan evolves from the initial value you set to the final value calculated by ueCalc. You need to specify how the metric will change month by month. For example, if you are working on lead acquisition and initially lack a clear strategy, you might spend the first few months testing hypotheses about tools to improve this process. Once you identify effective tools, you can begin improving the associated metrics. This change in metrics is often modeled using a sigmoid curve, which you can customize for each metric, including its shape.

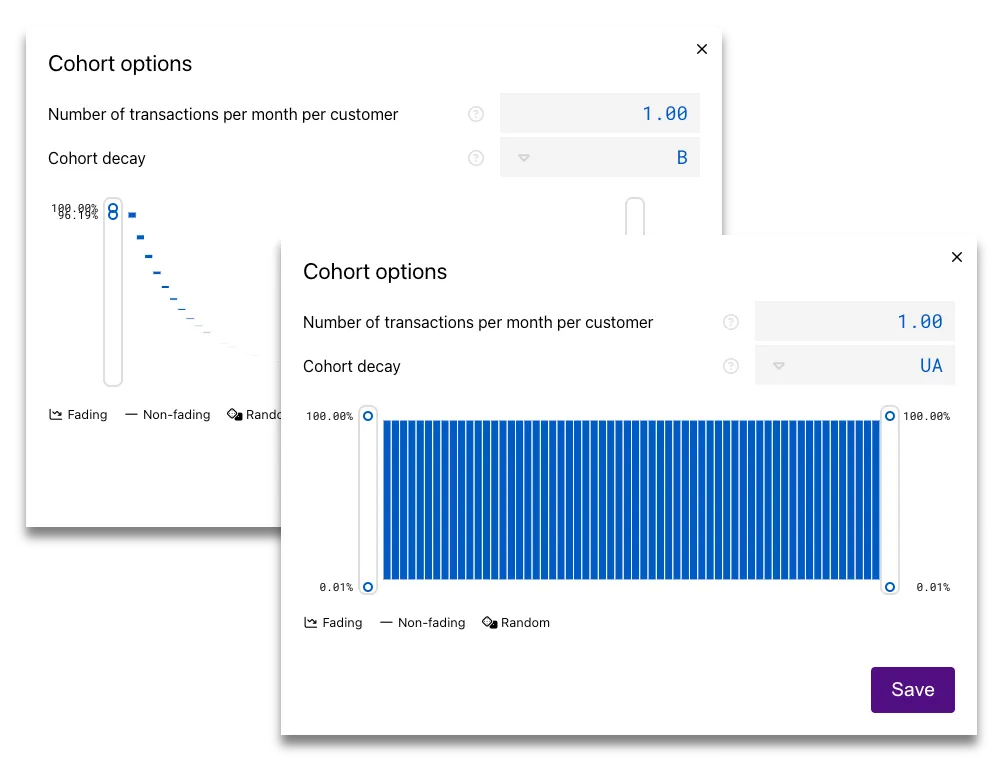

- Cohorts. To build a financial model, ueCalc uses cohorts to calculate the number of new leads, returning users, customers, and transactions. You don’t need to manually calculate these cohorts; ueCalc handles it automatically.

- Cohort Decay. Each cohort can exhibit different behaviors; for instance, e-commerce customers might return to the product randomly, whereas subscription service customers typically use the product regularly, leading to a smoother decay in the churn curve. In ueCalc, you can specify the type of cohort decay curve for leads, new customers, and returning customers.

- Seasonality. Your business may experience distinct seasonal variations, which you can easily set in ueCalc. Customize the seasonality for both leads and customers to reflect these patterns.

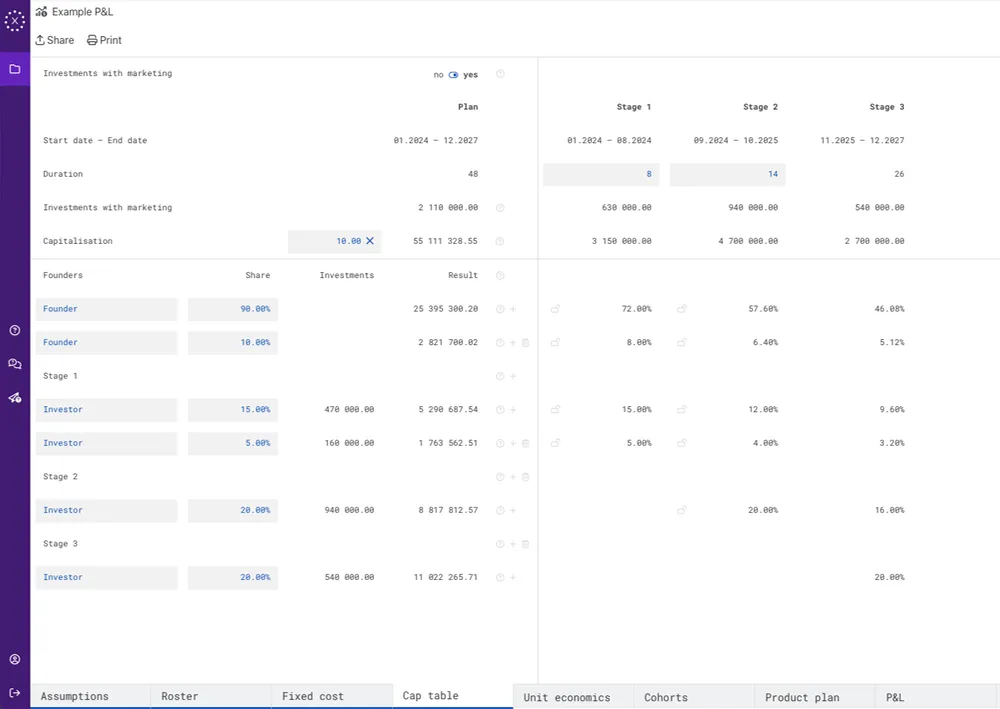

- Capitalization Table. ueCalc automatically calculates the required investment based on your data. It determines the investment needed by assessing the model's projected losses and estimating the marketing costs incurred after reaching the break-even point.

- Investment Stages. You can easily set up different investment stages, and ueCalc will automatically calculate the required investment amount for each stage.

- Shareholder ueCalc employs a straightforward capitalization table where you can define the ownership shares of the founders and investors for each investment stage. It will also calculate the distribution of shares at the end of the plan and the final capitalization.

- Capitalization. ueCalc calculates capitalization as the sum of EBITDA for the most recent plan year, using a multiplier specific to your industry.

- Product Plan. Your model in ueCalc also includes a product plan, detailing the monthly changes in the metrics that describe your business processes throughout the plan's duration.

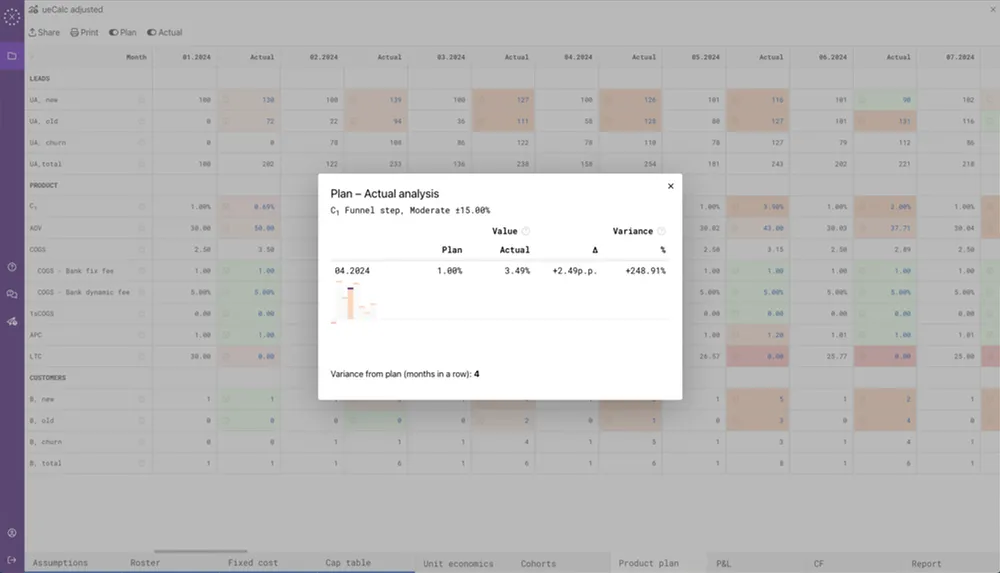

- Plan-Actual Analysis. With subscription plans, you can input the actual values of the metrics you obtained during your project and analyze the deviations from the planned values, including how often and by how much these deviations occur. This helps you identify which processes are not performing as expected and require your attention.

We strive to make our templates as clear as possible for both businesses and investors, ensuring that all our templates comply with the international FAST standard.

Create your own financial model!

Daniil Khanin, CEO ueCalc

How to show the model to an investor? Since ueCalc uses a complex mathematical algorithm based on Goldratt's constraint theory to calculate the predicted model states, which is not implemented through Excel or Google Sheet formulas, it is impossible to upload our models from ueCalc, but you can easily share a link to your model with anyone and they will get full access to it.Can I use ueCalc if I am consulting startaps? ueCalc has a special plan for consulting agencies, where you can bring your clients into the service yourself and give them personalized access for the models you create for them.Can ueCalc models be used to verify the plan execution? Users running on the Business plan get access to the plan-actual analysis and can use the built model to check the plan execution.If a business model has multiple monetization types? Currently, ueCalc does not support mixed monetization within a single product. However, creating such templates is a priority for us. In the meantime, we recommend using separate templates for each type of monetization.ueCalc can't find a metric configuration? For some business models, the metric configuration that achieves the margin target may not be available given your constraints. If you encounter this message, consider adjusting the target value or the metrics configuration. For SaaS business models, the most common issue is related to the distribution of customers across pricing plans. We recommend starting by limiting the change to the metric—such as the share of customers per pricing plan—or prohibiting ueCalc from changing it at all. First, build a working model, and then revisit the settings for this metric.Can the model be recalculated? If, after creating the model, you observe regular deviations between actual metric values and the planned ones, it is recommended to recalculate the model. This may involve adjusting the improvement rates of other metrics or changing the limit values.

ueCalc

Made with love for the whole world

We believe that anyone can attempt to start their own business, and we are here to assist them.

- Products

- Calconomics

- Company

- © 2026 Khanin Solutions S.L.

Barcelona, Spain