Unit economics, business process analysis, and cohort approach transform your team’s processes into an investor-ready financial model in 30 minutes!

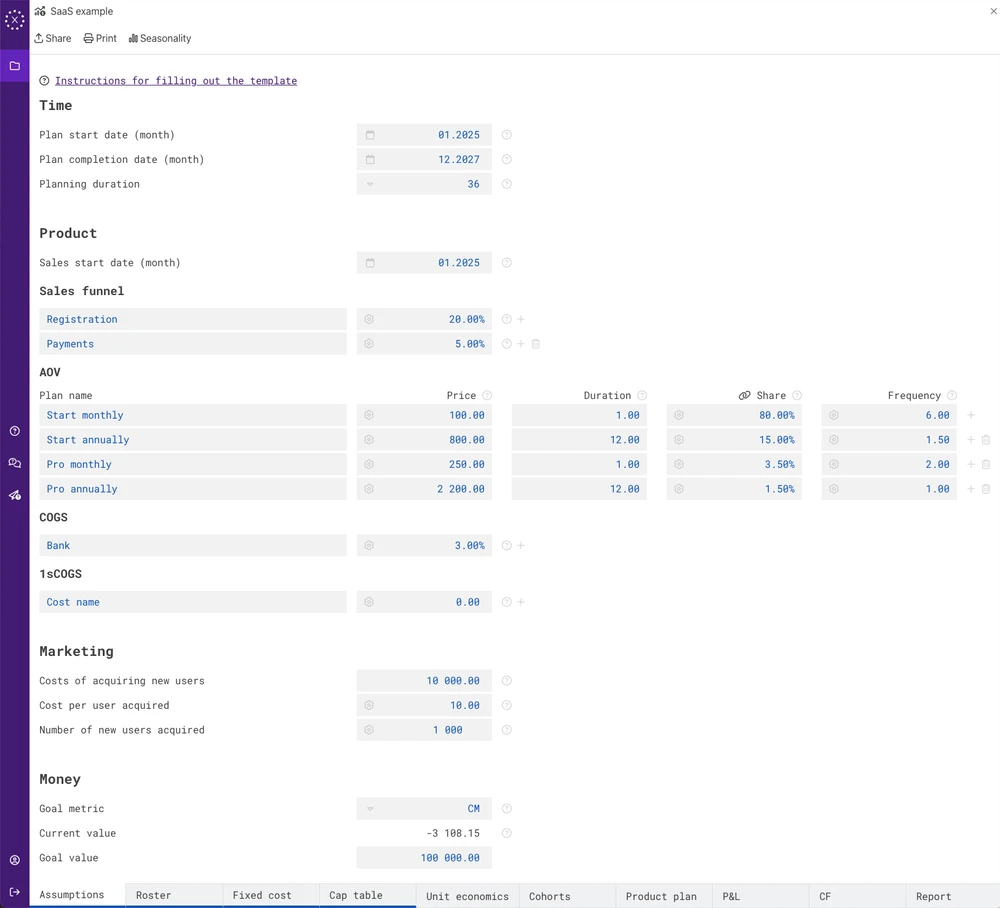

- Planning Duration. Specify the start month and planning period. SaaS startups typically plan their business for 3-5 years. Therefore, select the first month of the plan and the duration in months, e.g., 36-60 months. You can adjust these values later when working with the model.

- Describe your sales funnel. In SaaS startups, users typically visit the website, register, and purchase a subscription. This results in two steps: registration and service payment. Specify the conversion rate in percentages for each step, and ueCalc will automatically calculate the final conversion and incorporate your funnel into the financial model.

- Describe your pricing plans. SaaS startups typically offer multiple pricing plans. Describe each: subscription price, duration (monthly or yearly), share of customers choosing the plan, and renewal frequency. If unsure about frequency, enter 1. For example, 3 pricing plans with 2 durations result in 6 plans—describe each. ueCalc will automatically calculate your average order value (AOV) and average payment cycle (APC) for your model.

- Specify your variable costs. SaaS startups typically incur costs related to payment processing (2–5%). For complex cost structures, add expense categories, and they’ll be included in the model. Also, account for marketing expenses: select two of three parameters: total marketing spend, number of leads, or cost per lead and ueCalc will automatically calculate the remaining parameters for your model.

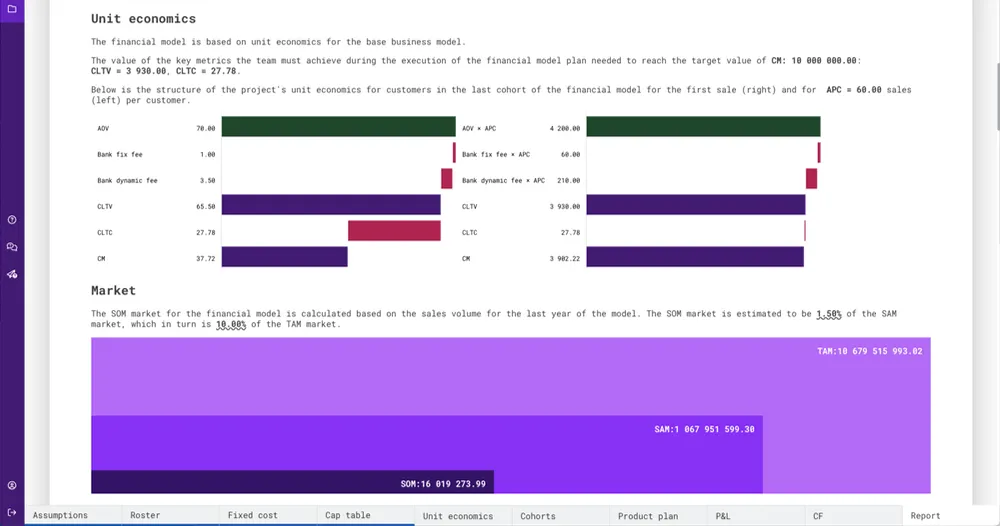

- Set your goal. At this stage, ueCalc has already calculated your unit economics. Simply enter the target profit margin for the last month of your plan, and ueCalc will automatically generate a product plan for your model.

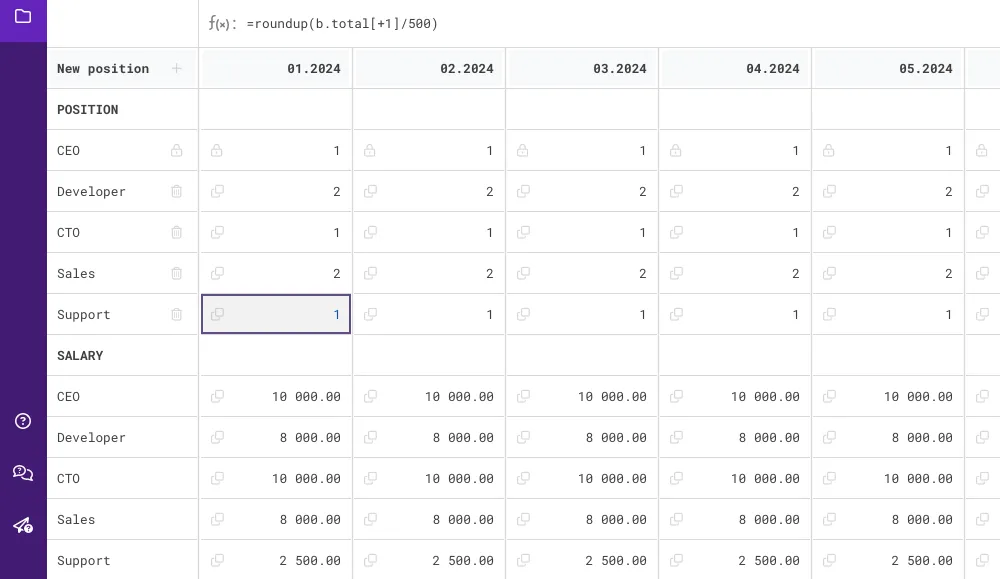

- Staffing Plan. Specify your employees’ positions (e.g., developer). In ueCalc, adding a position creates two rows: number of employees and their salaries. Enter data in one cell, and ueCalc fills the table. You can link employee numbers or salaries to product plan metrics, like customer count, and ueCalc will automatically calculate the rest.

- Specify fixed costs. List expenses independent of sales, such as office rent, servers, CRM licenses, and software. Link expenses to model parameters, like rent to staff size. Enter data in one cell, and ueCalc will automatically fill in the rest.

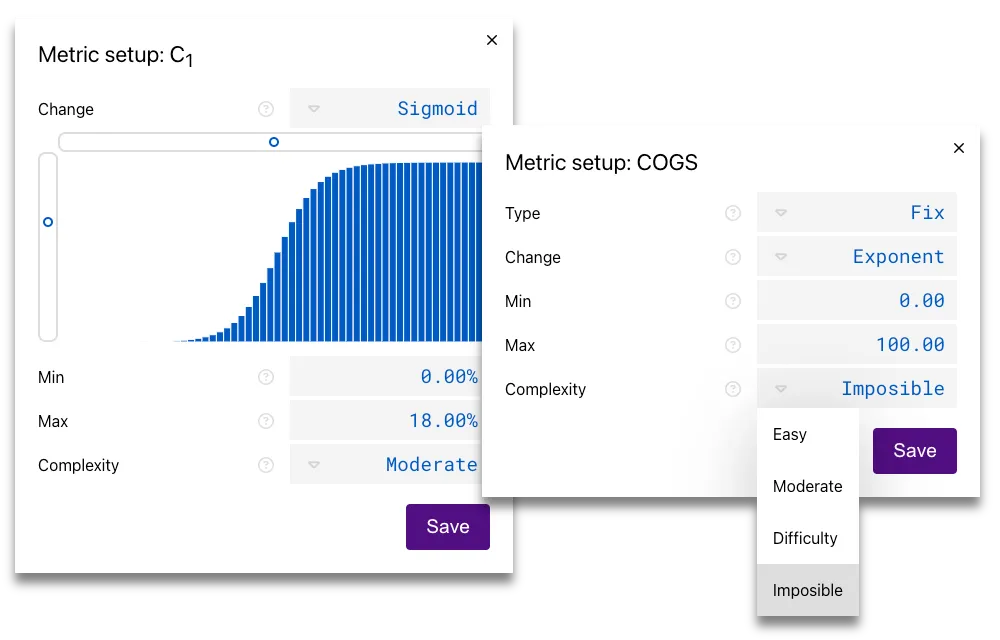

- Specify metrics. Customize each metric of your business model by setting constraints for ueCalc algorithms, such as minimum and maximum values. ueCalc will automatically incorporate them into your model.

- Specify metric complexity. ueCalc optimizes business processes. Indicate the complexity of changing metrics: if a process is harder to improve, note it in the settings. For unchangeable processes, like payment processing fees, mark them, and ueCalc will automatically account for all constraints.

- Specify growth rates. Each process improves from your starting value to a target calculated by ueCalc. Indicate how metrics change month by month. For example, for lead acquisition, note growth after testing tools. Use a sigmoid curve for each metric and adjust its shape, ueCalc will calculate the rest.

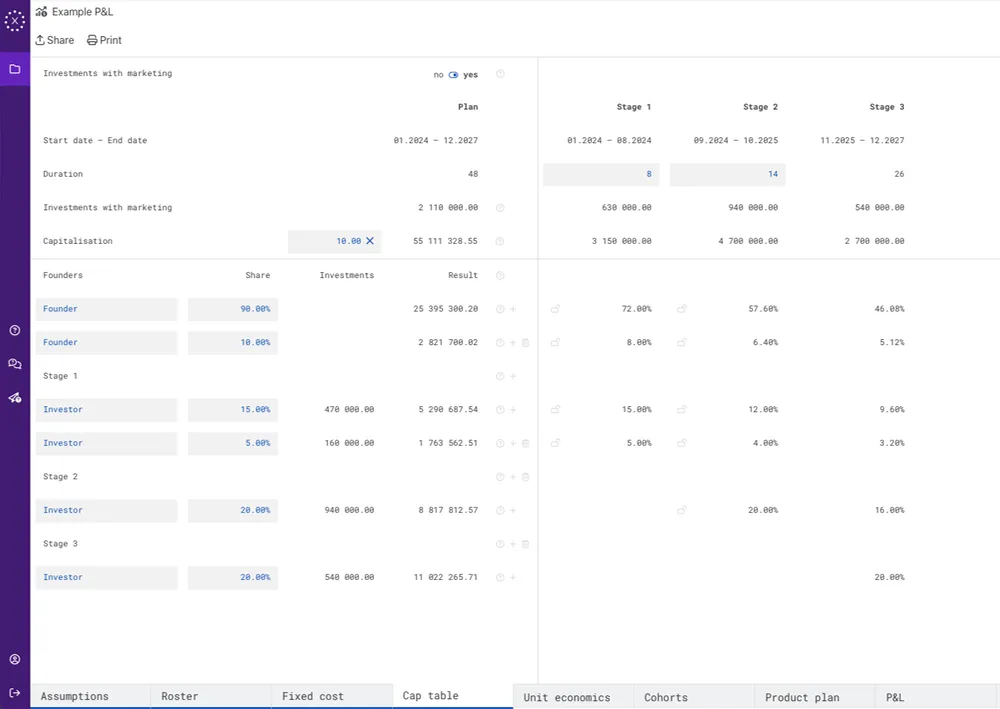

- Specify founders. Enter the founders’ ownership shares. ueCalc will automatically calculate the capitalization and value of their shares at the plan’s end, factoring in multipliers and projected sales for the final year.

- Specify investment rounds. List rounds, e.g., preSeed (12 months) and Seed (24 months). For each round, note investors (if known) and business shares. ueCalc will automatically calculate investment volume, capitalization, and returns for your model.

- Your financial model. After completing 4 steps, you get a ready-to-use model, including a monthly product plan for improving business processes, P&L and CF plans, and a summary report with details on plan duration, break-even point, investments, capitalization, unit economics, and model parameters. ueCalc calculates everything automatically.

- Share your model. Easily share it with partners and investors: download the PDF or send a document link. No ueCalc account is needed to view it.

ueCalc makes building a financial model easy. These steps let you create a startup model in 30 minutes.

Daniil Khanin, CEO ueCalc

How to show the model to an investor? Since ueCalc uses a complex mathematical algorithm based on Goldratt's constraint theory to calculate the predicted model states, which is not implemented through Excel or Google Sheet formulas, it is impossible to upload our models from ueCalc, but you can easily share a link to your model with anyone and they will get full access to it.Can I use ueCalc if I am consulting startaps? ueCalc has a special plan for consulting agencies, where you can bring your clients into the service yourself and give them personalized access for the models you create for them.Can ueCalc models be used to verify the plan execution? Users running on the Business plan get access to the plan-actual analysis and can use the built model to check the plan execution.If a business model has multiple monetization types? Currently, ueCalc does not support mixed monetization within a single product. However, creating such templates is a priority for us. In the meantime, we recommend using separate templates for each type of monetization.ueCalc can't find a metric configuration? For some business models, the metric configuration that achieves the margin target may not be available given your constraints. If you encounter this message, consider adjusting the target value or the metrics configuration. For SaaS business models, the most common issue is related to the distribution of customers across pricing plans. We recommend starting by limiting the change to the metric—such as the share of customers per pricing plan—or prohibiting ueCalc from changing it at all. First, build a working model, and then revisit the settings for this metric.Can the model be recalculated? If, after creating the model, you observe regular deviations between actual metric values and the planned ones, it is recommended to recalculate the model. This may involve adjusting the improvement rates of other metrics or changing the limit values.

ueCalc

Made with love for the whole world

We believe that anyone can attempt to start their own business, and we are here to assist them.

- Products

- Calconomics

- Company

- © 2026 Khanin Solutions S.L.

Barcelona, Spain